Contract risks are a lot like the weather. We’ve all been there: the sun’s shining, not a cloud in the sky, then just a few minutes later, you feel that first drop of rain hit your shoulder. Slowly, the clouds roll in, the wind picks up, and before you know it, it’s a full-blown storm.

It’s a situation that you might have been able to avoid if you just checked the weather.

And the same can be said about contract risks. You’ve signed your contract and everything seems peachy, but then a storm rolls in without warning.

That's why we created this list of contract risk management best practices.

Managing risk is all about being prepared. And to be prepared, sometimes all you need to do is check the weather!

TL;DR

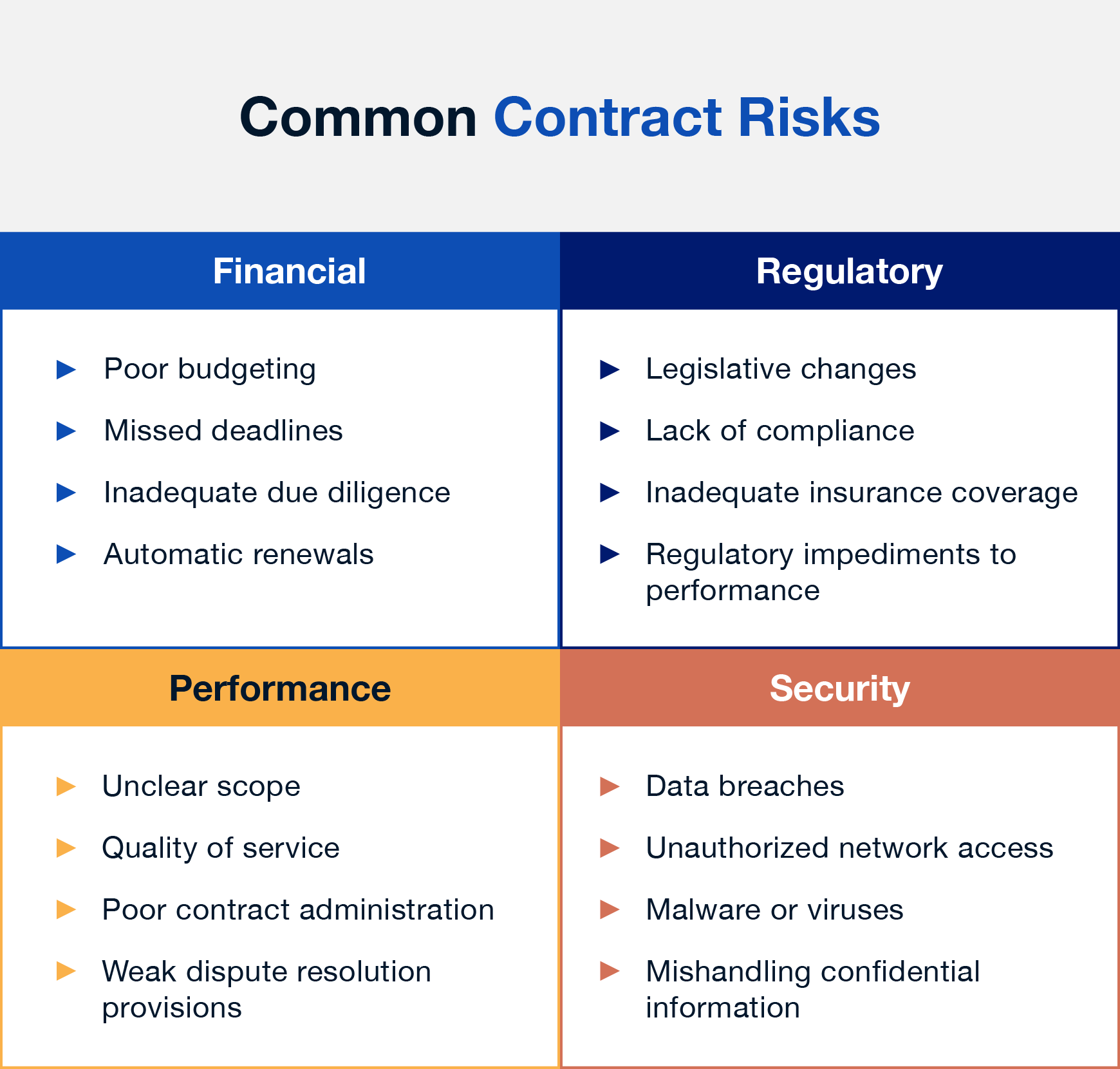

- Many contract risks fall into one of four categories: financial, regulatory, performance, and security.

- Having a plan in place and a few key tools on hand can help you protect your business from contract risks.

What Is Contract Risk Management?

Contract risk management is the practice of assessing and mitigating risks associated with contracts.

It involves an in-depth evaluation of all contractual documents to determine any potential legal, financial, regulatory, or security risks that could impact your business.By understanding what could happen, you can take the steps necessary to protect your business.

What Are Some Common Contract Risks?

Contract risks come in all shapes and sizes, but many contract challenges fall into one of four categories.

- Financial: These are the risks that directly impact your bottom line. Some examples of financial risks include poor budgeting, inadequate due diligence in the procurement process, or missed or automatic renewals.

- Regulatory: This type of risk is associated with legal, regulatory, or industry compliance issues that may arise during the contract term. It can include a lack of compliance with laws and regulations like HIPAA or GDPR, unanticipated legislative changes, regulatory impediments to performance on contractual obligations, or inadequate insurance coverage.

- Performance: These risks can arise when one party doesn’t meet their contractual obligations, resulting in a breach of contract. Examples include unclear scope, disagreements over quality of service, poor contract administration, or weak dispute resolution provisions.

- Security: These are risks associated with data privacy, cybersecurity, and other areas. They could include the mishandling or loss of confidential information, unauthorized access to systems and networks, or a third party compromising the security of your data.

How To Manage Contract Risks Effectively

Contract risk management doesn’t have to be complicated, but it does require careful planning and execution.

1. Perform Regular Risk Assessments

Performing regular risk assessments helps guarantee that you’re prepared for any hail storm that may be looming on the horizon.

Consider using a risk assessment matrix to determine the likelihood and impact of potential risks to determine an informed course of action. A thorough assessment should include a review of the risks associated with the contract, as well as all contractual relationships held by a company. Being able to identify contracts with a higher risk profile can help you prioritize the areas that need to be addressed first, as well as pinpoint any weak spots in current contracts.

This step is a team effort, so it’s important to get legal, financial, and operational departments involved to ensure nothing is missed.

2. Standardize and Automate Contract Creation

You know why umbrellas exist? Because someone had the brilliant idea to create a template for staying dry. You can do the same with your contracts. Standardizing your contract creation process using plug-and-play clauses or even full contract templates will not just save you time — it’ll keep you safe. Instead of rewriting and re-vetting a specific clause or contract for every deal you make, you can simply use one that’s already been approved by your legal team. Here are some common risk mitigation clauses you may consider standardizing:

- Force majeure: A common addition to many types of contracts, this is intended to protect all parties in cases of unexpected events.

- Limitation of liability: This is an important clause specifying each party's responsibility in any situation.

- Indemnification: This clause is used to protect one or both parties from losses they may incur as a result of the contract’s performance.

- Warranties: This clause outlines any warranties the parties have made to each other regarding the goods or services being exchanged.

Having clauses like these pre-written and ready to be pasted into a new contract can save a ton of time and a lot of potential headaches.

3. Keep Track of Key Dates and Obligations

Missing key dates, deadlines, or renewals can be costly. Make sure you have a timeline to track obligations so you can ensure you’re always two steps ahead.

And when critical dates are approaching, make sure you’ve got alerts set up just in case. Shared calendars are great for this, but contract management tools are even better!

4. Ensure Compliance With Legal and Regulatory Requirements

Regulators are a contract manager’s worst nightmare.

And they don’t always make it easy to stay up to date, either.

Laws and regulations are always evolving to adapt to the world around them, so it’s important to be sure you’re following the rules.

Check industry resources and government press releases often, especially if you’re in particularly strict industries like finance or healthcare. No one wants a surprise visit from the Office of Civil Rights or the Securities and Exchange Commission.

5. Establish Clear Communication Lines With Stakeholders

Communication is essential in mitigating risk. Every contract should go through an approval process — not just from the legal team, but the finance and operations departments as well. Every contract carries different types of risks, and each department is uniquely equipped to spot things that others might miss. Opening up a clear line of communication between stakeholders can prevent costly mistakes and delays, and even streamline arbitration if a dispute arises later on.

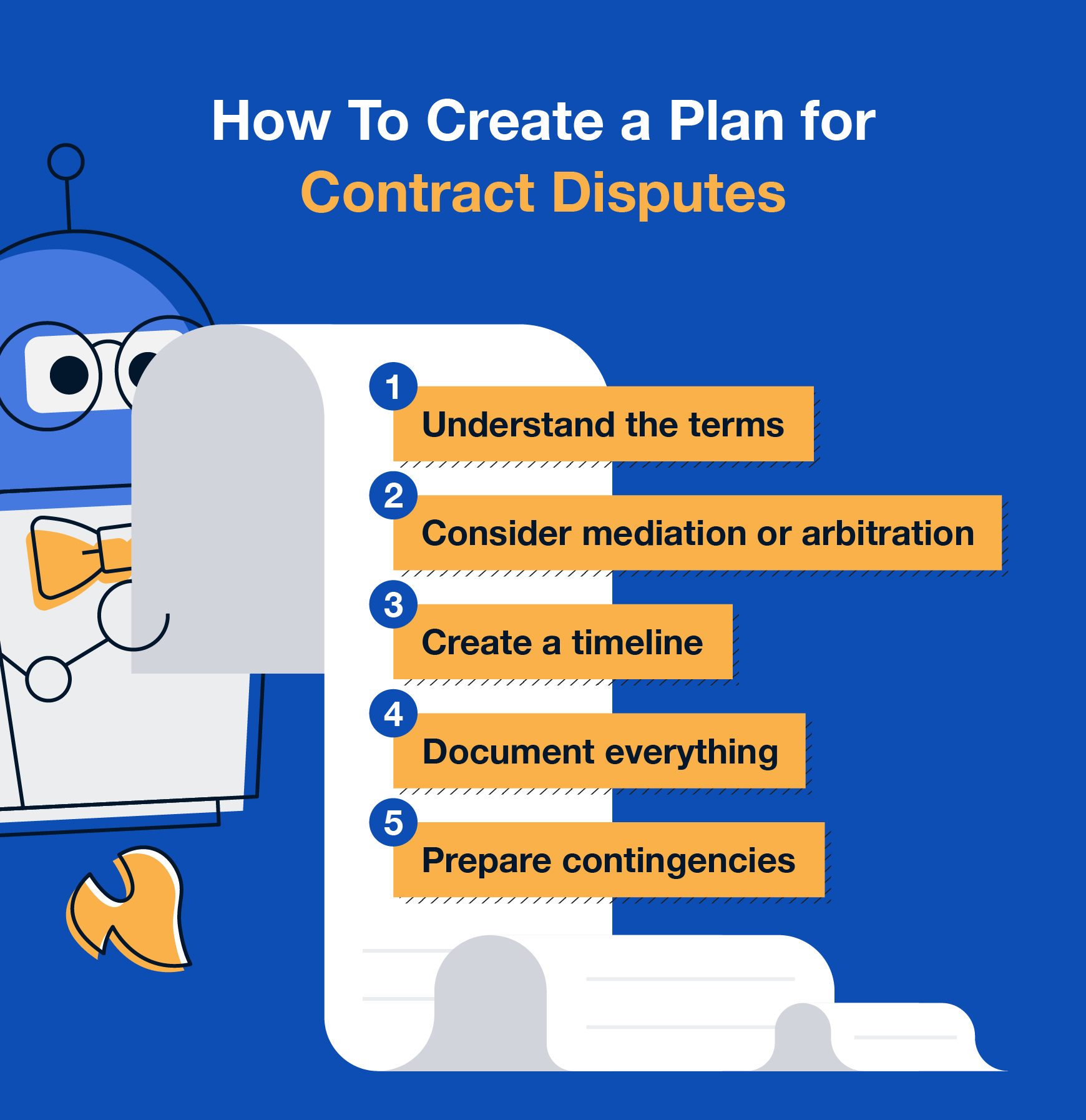

6. Have a Plan for Contract Disputes

When it rains, it pours, as they say. That’s why it’s important to have a plan in place if things do go south.

Follow these steps to create a plan for contract disputes:

- Understand the terms of the contract.

- Consider mediation or arbitration before resorting to litigation.

- Create a timeline for when different steps should take place.

- Document each stage of the process.

- Prepare contingencies in case things do not go as planned.

And remember, always consult a lawyer or your in-house counsel to guide your plan!

7. Train Employees on Contract Management

Anyone who touches contracts should know a thing or two about how they work and what to look out for. Keep your team informed with regular training sessions to ensure everyone is up to date on contract management best practices. It’s also not a bad idea to assign someone as the “contract guru” so your team has someone to go to for any contract-related questions or concerns.This will help ensure there’s always someone available for guidance.

8. Streamline Legal Reviews

Contracts are complex. And when you’re dealing with large volumes of them, it can be easy to miss something.

That’s why it’s important to have a streamlined process in place for legal review.Having a set process can guarantee that each contract receives the attention it needs. Here are a few things you can do to make the review process a little easier:

- Create standardized templates for common contracts or clauses.

- Establish clear review guidelines.

- Use AI to automate the initial review stage.

- Make sure everyone involved understands their responsibilities.

Streamlining the process can save your team time so they can focus on more value-added tasks.

9. Perform Regular Audits

You can’t manage what you don’t measure.

It’s important to perform regular audits of contracts and their performance.

This can help identify potential risks that may arise throughout the lifecycle of a contract, allowing you to get ahead of them before they become a problem.

Audits can be performed by someone within the organization, but having a pair of fresh eyes from outside the company can be helpful as well.

10. Embrace Technology

Technology is a contract manager’s best friend.

One of the biggest game-changers is cloud-based centralized repositories. Not only can they help eliminate the risk of losing important documents, but they also make finding key clauses or counterparty details incredibly easy.And that’s just scratching the surface.If you really want to level up your contract management, consider investing in contract management software. Contract management software can help in every stage of a contract’s lifecycle. You can use it to automate organization, streamline approval workflows, and even leverage e-signatures to make signing a breeze, helping you get more done in less time. Plus, it can send alerts to ensure you never miss a deadline.

De-Risk Your Contract Management Processes

Adopting these 10 best practices won’t save you from every downpour that might arise, but it can certainly help!

If you’d like to take your risk management to the next level, consider adopting contract management software (like ours!). Schedule a demo with ContractSafe today to see how you can use tech to help mitigate risks.