Most people treat contract management like paperwork. In reality, it’s a financial system that shapes everything from cash flow to compliance exposure. Contract management software directly impacts the bottom line by preventing overspend, accelerating revenue, reducing legal costs, and improving financial visibility across the contract lifecycle.

Most business spend is controlled by contracts—yet many organizations still manage them across inboxes, shared drives, and spreadsheets. That disconnect creates blind spots: missed renewals, unmanaged obligations, pricing escalators that quietly compound, and audits that turn into fire drills.

Before we dig into where organizations lose money (and how to stop it), here are a few grounding realities:

Quick Facts

- 70–80% of business spend is governed by contracts

- Poor contract management can cost businesses up to 9% of their annual revenue.

- Many contracts have automatic annual price escalation clauses of 2%-5% built in or an inflation-adjusted increase tied to the Consumer Price Index (CPI).

These aren’t edge cases or hypotheticals. This is everyday financial leakage that most organizations don’t see until it hits the budget.

This guide shows how contract management software positively affects your bottom line—not just through efficiency, but through measurable, hard-dollar ROI across the entire contract lifecycle.

TL;DR

Organizations lose real money through missed renewals, slow approvals, unmanaged obligations, and fragmented contract storage. Contract management software reverses that leakage by improving visibility, standardizing processes, eliminating manual work, and accelerating execution.

A Guide to Unlocking Hard-Dollar Savings With Your Contract Management Software

When trying to make the case for contract management software, your leadership team wants to know why it's worth it. After all, contracts are already being managed... right? So telling them "it'll save time" or improve "team morale" isn't going to cut it. They want to know the value in real dollars.

Contract management touches spending decisions, revenue timing, and audit readiness. Scattered contracts put those outcomes at risk. Centralized, organized, tracked contracts help teams make better renewal, budgeting, and negotiation decisions.

This guide is here to help you connect the dots between contract management and bottom-line impact.

RELATED READ: What Is a Contract Repository? +6 Key Features You Need

How Does Contract Management Impact Financial Performance?

Contract management is a major part of financial performance because contracts control the money; both what's coming in and what's going out.

As a vendor, contracts determine when you get paid, how much, and under what conditions. Slow contract cycles delay revenue recognition. Unclear payment terms create collection headaches. As a buyer, contracts dictate what you'll spend, when costs escalate, and what penalties you'll face if something goes sideways.

Whether you're managing customer agreements or vendor relationships, contract data drives forecasting, accruals, and cash flow planning. That makes contract management a finance function . . . even if it doesn't live in Finance.

How Much Does Manual Contract Management Actually Cost?

It’s hard to put a number on exactly how much manual contract management costs. But when contracts live in inboxes, shared drives, or spreadsheets, every workflow becomes slower, riskier, and more expensive. Manual processes create hidden financial drains across Legal, Finance, Procurement, and Operations—often without anyone realizing it.

Manual contract management costs companies money in these 8 primary ways:

-

Unintended renewals that lock teams into unplanned spend

-

Time and legal hours lost recreating contract history

-

Lost versions or slow approvals delaying revenue or vendor onboarding

-

Audit response time ballooning as teams search for documentation

-

Invoices paid without validating contract terms

-

Duplicate tools purchased by different departments

-

Contracts drafted from scratch due to missing templates

-

Legal reviewing the wrong version due to lack of version control

These aren’t rare cases; they’re everyday occurrences in organizations managing contracts manually.

Why Do Organizations Underestimate Contract-Related Financial Risk?

As outlined earlier, when contracts are managed manually, financial risk doesn’t appear all at once. It accumulates quietly across departments through missed renewals, unmanaged escalators, and overlooked obligations—making the true cost easy to underestimate until it hits the budget.

Which Department Sees Financial Impact from Contract Management?

In short, all of them. The financial leakage—money that slips away because no one is paying close attention—caused by manual contract management shows up differently across teams. However, it stems from the same root issue: lack of centralized visibility.

Contract Return on Investment (ROI) spans the organization:

-

Finance: accrual accuracy, renewal control, audit defensibility

-

Legal Ops: fewer reviews, standardized language, less rework

-

Procurement: stronger negotiation leverage, fewer duplicate vendors

-

Operations: faster onboarding, clearer ownership

-

RevOps: shorter sales cycles, fewer stalled deals

The Cost of Manual Contract Management (Where Money Leaks Today)

.png?width=532&height=757&name=CTSF_DecArticle1_Graphic1%20(1).png)

As discussed earlier, poor contract visibility is the primary driver of contract-related financial loss. The table below shows where money leaks in manual environments—and how a modern CMS recovers that value.

Before Contract Management Software vs. After Contract Management Software: Where Money Leaks & Where It Gets Recovered

|

Before CMS (Manual Contract Management) |

After CMS (Modern Contract Management Software) |

|

Missed renewals due to scattered storage and no alerts |

Automated alerts catch renewal windows early and prevent surprise escalations |

|

Auto-renewals increase pricing 2–5% with no oversight |

Renewal visibility enables renegotiation leverage and better cost control |

|

Customer renewals get overlooked limiting expansion opportunities |

Renewal forecasting surfaces upsell/expansion conversations proactively |

|

Departments buy overlapping tools at different prices |

Centralized visibility leads to vendor consolidation and lower rates |

|

Slow reviews stall revenue and onboarding |

Clear approval workflows and integrated e-signature keep contracts moving instead of sitting in limbo |

|

Nobody knows where a contract is stuck |

Contract Lifecycle Tracking show routing, bottlenecks, and accountable owners |

|

Version confusion leads to redlines on the wrong draft |

Version control eliminates rework and speeds negotiation |

|

Legal loses hours hunting for documents |

Search and AI-assisted extraction finds clauses instantly |

|

Compliance gaps can lead to audit findings and penalties |

Obligations, SLAs, and documentation tracked automatically |

|

Every contract is drafted from scratch |

Templates and approved fallback language reduce review time and inconsistency |

Missed Renewals and Unfavorable Auto-Renewal Terms

Renewals are one of the most expensive failure points in manual contract management.

Without centralized visibility:

-

Auto-renewals quietly increase pricing year over year

-

Missed notice windows lock teams into unwanted terms

-

Late renewal negotiations reduce leverage

-

Overlooked expansion and upsell opportunities

Duplicate or Unoptimized Vendor Spend

Most organizations don’t set out to pay multiple vendors for the same thing.

When contracts are decentralized:

-

Multiple departments buy overlapping tools

-

Vendor ownership is unclear

-

Procurement lacks a complete view of contractual commitments

-

Consolidation opportunities stay invisible

The cost shows up slowly as redundant spend, missed volume discounts, and no leverage to negotiate better terms.

Slow Contract Review Stalls Revenue

When contracts sit in the limbo of someone’s inbox or someone else’s to-do list, deals can stall. This adds time to negotiation periods and can put revenue at risk.

Some common bottlenecks are:

- Version confusion causes rework: Sales sends v3, customer redlines v2

- Approvals sit in queues: An approver is on PTO and nobody set a backup plan

- One missing signature stalls the whole process: One stakeholder deleted an email and doesn’t know they’ve caused a stoppage

Each delay pushes revenue recognition further out, even when the business is ready to move.

Compliance Gaps That Trigger Financial Penalties

Compliance issues often surface long after the contract is signed—usually during an audit, a dispute, or a regulatory review. At that point, the cost isn’t just theoretical. It’s a penalty, a settlement, time lost, and an impact on your organization’s credibility.

These are some examples of exposures that can be overlooked until it’s too late:

-

You agreed to destroy customer data within 30 days of termination. You didn’t. That’s a breach notice

-

Your vendor’s insurance lapsed below the contractual minimum. Now you’re carrying risk.

-

A quarterly reporting requirement was buried in section 14. Now it’s an audit finding.

-

The executed version with the liability cap? Nobody can find it. Now you’re negotiating from memory,

What starts as simple disorganization often turns into real financial exposure.

Legal Hours Lost to Busywork

Legal teams don't spend hours hunting for contracts because they want to. They do it because information isn't easy to find. When contracts aren't accessible, Legal becomes the default search engine.

The world nobody budgets for:

-

Someone in Procurement needs the termination clause from a 2024 vendor agreement. Legal spends 45 minutes digging through shared drives.

-

Sales asks "can we offer these payment terms?" No templates or playbooks exist, so Legal reviews the same language for the third time this quarter.

-

An M&A due diligence requests lands. Legal spends two days rebuilding amendment history that should have taken two hours.

-

Outside counsel bills eight hours for audit prep; half of that time spent waiting on documents Legal couldn't locate quickly.

This is where inefficiency quietly turns into a recurring expense.

RELATED READ: Cut Legal Spend Fast with Smarter Contract Lifecycle Management

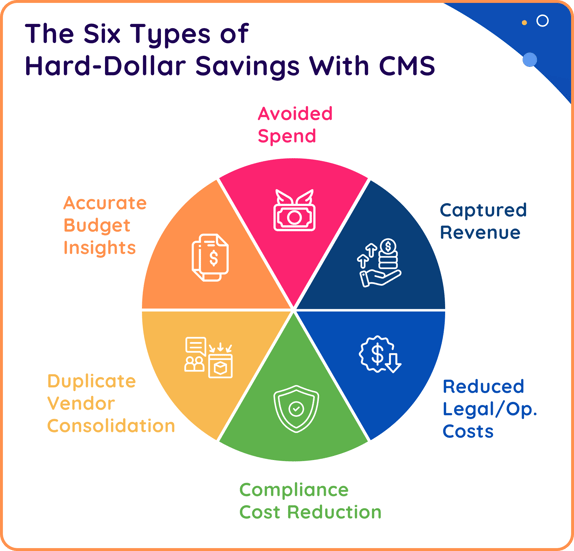

The Six Types of Hard-Dollar Savings With Contract Management Software

Before calculating ROI, it helps to understand the specific categories of savings contract management software delivers.

Category 1: Avoided Spend

Avoided spend prevents money from leaving the business unnecessarily.

Contract management software prevents overspending by:

-

Catching renewals before auto-renewals trigger

-

Surfacing pricing escalators before they trigger

-

Identifying termination opportunities

-

Helping to flag duplicate vendors across departments

Even a small number of caught renewals or found termination opportunities can outweigh the cost of a CMS.

Category 2: Faster Time to Revenue

Revenue is often lost to delays, not pricing. The longer it takes to sign, the more time parties have to reconsider.

Faster contracting leads to:

-

Shorter negotiation cycles through standardized language in templates

-

Faster approvals and signatures through automated routing

-

Earlier revenue recognition when nothing stalls between approval and e-signature

The financial impact comes from momentum: fewer stalled deals and faster time to cash.

Category 3: Reduced Legal and Operational Costs

Teams see direct cost savings by reducing the repetitive work that pulls people away from higher-value legal work.

A CMS can provide Instant savings from from:

-

Instant search replacing document hunts

-

Templates reducing drafting time for routine agreements

-

Version control eliminating “which draft?” agreement

-

AI contract review flagging risks and issues in minutes

-

Self-service access reducing the “Hey, can you find this contract for me?” requests

A CMS also reduces legal consultation costs and becomes measurable. Not through automation hype, but through less unnecessary work landing on Legal’s desk.

Category 4: Compliance Cost Reduction

Compliance cost reduction comes from faster audits and stronger documentation.

Centralized contracts can lead to:

- Reduced audit prep time

- Improved defensibility with complete version histories

- Lowered risk of penalties tied to missing documentation

When documentation is easy to find and clearly versioned, audits stop feeling like emergencies.

Category 5: Consolidating Duplicate Vendors and Overlapping Tools

Vendor consolidation only works when teams can see the full picture. A CMS helps unearth overlap by creating a central, searchable repository for your whole organization.

Stop paying three vendors for the same job with the help of:

- A central repository means every vendor contract lives in one place

- Metadata extraction captures vendor names, terms, contract types and execution status

- Search and Filters let you look up every contract type across the company in seconds

Searching and filtering your vendor contracts can help spot overlap and actually impact procurement decisions.

Category 6: Accurate Budget Insights & Forecasting

Without a clear, central view of obligations, companies suffer from budget variance—paying for unwanted renewals or missing savings opportunities.

With a better look at your contracts, you can:

-

Spot automatic price escalators and increase budgets accordingly

-

Smooth out major expenses by tracking and accounting for effective dates

-

Avoid unwanted auto-renewals and zombie spend

-

Predict cashflow with clear visibility into payment terms

A CMS helps replace guessing with accuracy when it comes to planning budgets and predicting revenue.

RELATED READ: How to Build a Rock-Solid Business Case for Contract Lifecycle Management Software

How Centralized Contracts Reduce Internal and External Legal Costs

Contracts are often long. They’re dense. They’re practically designed to make finding anything difficult. A CMS not only provides a centralized repository for your contracts, it also cuts down on time to review, write, and query contracts.

Internal Efficiency

Legal can only handle so much in a day. And outside counsel is expensive and sometimes slow. Contract management software empowers other teams to find their own answers to time-sensitive questions.

Thanks to search functions, Operations, Finance, and Procurement no longer rely on Legal for lookups. And real-time access to active terms answers questions immediately and reduces escalations.

Outside of review, a CMS can house templated language or templates of entire contracts, meaning Legal doesn’t need to review the same contract over and over.

Outside Council Reduction

According to a survey, contract professionals spend as much as two hours finding specific language in a contract. AI can find it instantly. In fact, Gartner estimates that by next year, manual labor in the contract review process will be reduced by 50% with the help of AI. This means reviews and audit packets can be completed in minutes, not days.

RELATED READ: The Ultimate Contract Repository Guide: How to Build, Automate, and Prove ROI

ROI Across Each Stage of the Contract Lifecycle

ROI appears at every stage of the contract lifecycle, from creation through renewal. To measure the real return on investment of contract management, you have to look beyond time savings. At its most basic level, the ROI of a CMS is how much money is saved vs. how much money you spend on the software. But beyond that, contract ROI is the balance between:

- How fast revenue enters the company

- The direct reduction in administrative labor

- The prevention of lost cash through missed renewals, penalties, and unmanaged escalations.

Below is a breakdown of where financial impact typically appears.

How Does Contract Creation Affect ROI?

Right at the beginning, pre-approved templates reduce the need for high-cost legal counsel. By enabling sales or operations to draft standard agreements with pre-approved language you significantly lower the labor cost per contract. And if something makes it in that shouldn’t—or someone shouldn’t be editing any more—version control prevents errors that cost rework time.

How Can Contract Management Speed Up Negotiation?

Negotiation is a make or break stage when it comes to revenue. Friction during negotiation can stall deals. By using standardized clause libraries, you reduce redlining cycles. And pre-planned and enforced workflows prevent bottlenecks in the process. This shrinks the gap between a verbal “yes" and "invoice sent," bringing cash into the business weeks earlier.

How Does Faster Execution Affect Revenue Timing?

Every day a contract sits unsigned increases the risk of the deal falling through. Integrated e-signature can save days or weeks, and no lost signatures means no need to re-send. A digital route speeds the entire process because you aren’t waiting on manual routing or back and forth.

How Can Post-Signature Management Avoid Penalties?

The work isn’t done once a contract is signed. A CMS makes it easy to get full visibility into cost escalators, discounts, and renewal terms. While alerts remind you to track (and meet) obligations and prevent financial penalties.

How Does Monitoring Renewals & Expansions Impact Budget?

Renewal is the highest leverage point for savings. With advance notice of expiration, you regain negotiation leverage, allowing you to consolidate vendors or dispute price increases rather than being forced to accept them under pressure. A CMS allows you to accurately forecast renewals, identify renegotiation opportunities, and reduce vendor sprawl.

How Can Reporting & Analytics Help With ROI?

A central place and visibility into all your contracts means nothing can surprise you. Reporting and Analytics capabilities allow you to easily see your renewal pipeline, forecast spend exposure, track vendor performance, and complete obligation compliance reporting.

Realistic Business Cases of ROI

ROI isn't theoretical when you're managing hundreds of contracts. It shows up in avoided costs, recovered time, and revenue that hits your books faster. Here's how the math works in practice.

Scenario 1: Catching Auto-Renewals and Negotiating from Strength

Every contract portfolio has them: vendors with auto-renewal clauses and built-in price escalators. When renewal notices get buried in someone's inbox or sent to an employee who's since left, those clauses trigger automatically. But the cost isn't just the price increase you didn't catch. It's the negotiating leverage you never had.

The real cost: A $40,000 vendor contract with a 5% auto-escalation becomes $42,000 if you miss the opt-out window. Worse, you’ve lost the window to renegotiate, consolidate vendors or put the contract out to bid.

Multiply that across your portfolio: if just 10 of your 300 contracts have similar clauses, that's $20,000 in avoidable spend every year.

With a CLM: Automated alerts notify your entire team 30, 60, 90 days before renewal. Price escalation terms are flagged during contract upload. Instead of scrambling after the fact, you're renegotiating from a position of strength

The potential opportunity in this scenario is as follows:

-

Avoiding a 5% escalation on a $40,000 contract saves $2,000

-

Renegotiating a 10% reduction on the base rate saves $4,000

-

Total opportunity per contract: $6,000.

Conservative estimate: Successfully renegotiating just 3 vendor agreements saves $18,000 annually.

Scenario 2: Audit Prep That Doesn't Derail Your Week

Audits happen. Regulatory reviews, vendor assessments, internal compliance checks and every one of them requires pulling documentation. For most organizations, that means someone on the legal or contracts team drops everything to hunt through emails, shared drives, and (if you're lucky) a folder someone labeled "FINAL_v3_ACTUAL."

The real cost: Without centralized contract storage, assembling audit documentation can take 8–10 hours per request. That's not just time spent searching, it's verifying you have the executed version, locating amendments and attachments, and reconstructing approval history. With 4 to 6 audit-related requests per year, you're looking at 40 to 60 hours annually that your team isn't spending on higher-value work like reviewing new deals or supporting sales.

With a CLM: Search is instant. Executed agreements, amendments, and attachments are stored together. Audit trails are captured automatically. What used to take a full day can now take 30 minutes.

Conservative estimate: At 50+ hours saved annually at $50/hr that $2,350 in recovered productivity—time your team can redirect to work that actually moves the business forward.

Scenario 3: Ending the Daily "Where's That Contract?" Drain

Audits aren't the only time contracts need to be found. Every week, someone on your team fields requests: "Can you send me the MSA for this vendor?" "What are our payment terms with X?" "Did we ever sign that amendment?"

These interruptions seem small in the moment. They're not.

The real cost: If your team handles 8 contract lookup requests per week—from legal, finance, procurement, sales, or executives—at 15 minutes each, that's 2 hours per week. Over a year, that adds up to 100 hours spent on what should be a 30-second search.

With a CLM: Anyone with appropriate access can find what they need instantly. Self-service search means fewer interruptions, faster answers, and a team that spends time on strategic work instead of playing fetch.

Conservative estimate: 100 hours saved annually × $50/hour = $5,000 in recovered productivity.

Scenario 4: Closing Deals Faster

Revenue isn't recognized until the contract is signed. Every day a deal sits in approval limbo, waiting for legal review, or chasing signatures is a day that revenue stays theoretical.

The real cost: A $25,000 contract that takes three weeks to execute instead of one week delays revenue recognition by 14 days. For a business closing 50 contracts per quarter, those delays compound: slower cash flow, longer sales cycles, and forecasts that don't match reality.

With a CLM: Automated routing eliminates approval bottlenecks. Version control means no one's working from an outdated draft. E-signature integration cuts the "waiting for ink" phase from days to hours. Organizations routinely see contract cycle times drop by 50–70%.

Conservative estimate: Accelerating just 20% of your quarterly contracts by two weeks puts revenue on the books faster—improving cash flow and making your forecasts more predictable.

KPIs that prove value (show me the money)

-

Renewal save rate (renegotiated or canceled auto-renews)

-

Cycle-time to find facts (e.g., liability cap or governing law)

-

% contracts with complete metadata (≥95%)

-

Audit readiness time (from days to minutes)

-

Missed-obligation rate (trending down)

-

Revenue assurance (fewer missed uplifts/price-escalations)

Industry leaders emphasize time saved, accuracy, and risk reduction as primary wins from a centralized repository and good metadata/automation.

The Compounding Effect: Stacking Real Savings

These scenarios don't happen in isolation. A single organization experiences all of them, repeatedly, across their contract portfolio. Here's what conservative estimates look like when you add them up:

For an organization paying $8,500/year for contract management software, that's roughly a 300% ROI—or about $4 back for every $1 spent.

And that's before you factor in:

-

Revenue acceleration from faster deal cycles (Scenario 4)

-

Risk reduction from better compliance visibility

-

The multiplier effect of managing hundreds of contracts, not just a handful

The reality? Most organizations see returns far higher than this because:

-

These scenarios repeat across hundreds of contracts, not just a handful

-

We've used conservative estimates at every step

-

We haven't quantified the risk reduction from better visibility and compliance

Contract management software doesn't need to transform your business to pay for itself. It needs to help you renegotiate a few vendor contracts, save your team from one bad audit week, and eliminate the daily "where's that contract?" interruptions

RELATED READ: The High Cost of Waiting: Why Now’s the Time to Upgrade Your Contract Management Game

How ContractSafe Delivers Bottom-Line ROI

ContractSafe is built for teams that want real financial impact from a tool that's easy to use. We’ve designed features to reduce manual work, prevent missed renewals, and accelerate execution.

Unlimited Users Means Lower Total Cost of Ownership

At ContractSafe, we want everyone to have access to the tools they need. Unlimited user licenses in your contract management software eliminate bottlenecks, foster collaboration, and empower decision-makers across your organization. Allowing for broad adoption across an organization means our CMS can deliver savings at every stage of the contract lifecycle and ultimately lead to a lower Total Cost of Ownership (TCO) across teams.

Fast Onboarding Means Faster Time to Value

ContractSafe is designed to work as soon as possible. Getting started is easier than you think—you can jump in with what you have, see results fast, and organize as you go. You can bulk upload all your existing contracts (whether they’re active, pending, or recently signed) into the system to make them searchable immediately, preventing spend, avoiding missed renewals, and catching overlap.

Beyond that, our onboarding process has:

- No implementation fees

- No steep learning curve

- No need for external consultants or legal-ops specialists

- Dedicated Customer Success Manager included on every account

- Full repository becomes searchable immediately

AI-Powered Visibility Reduces Legal & Operational Hours

ContractSafe’s AI automates repetitive tasks like data extraction, contract review, and search. This frees up valuable time for lawyers to focus on higher-level strategic work, such as negotiating better terms, advising business teams, and helping to manage risk.

Our AI tools reduce the workload for Legal with:

- Keyword and natural-language search

- AI clause extraction

- Obligation tagging

- AI summaries for fast understanding

- Renewal-risk insights

- Automatically extracted key data creates fast, portfolio-wide visibility

Automated Alerts Protect Financially Relevant Dates

Your team needs to cut costs by renegotiating all major vendor contracts before their renewal deadlines. Relying on spreadsheets and calendar reminders inevitably leads to missed renewals, costing companies thousands (or more!) in unwanted fees and lost leverage.

ContractSafe’s automated contract management is proactive, keeping you aware of:

- Renewal dates

- Expiration dates

- Notice periods

- Pricing escalators

- Milestones and deliverables

Our automated alerts act as a safety net, sending email notifications to the right people about key dates with plenty of lead time to take action and save money.

Predictable Pricing Tied to Contract Volume

ContractSafe is intentionally designed to be predictable, accessible, and transparent, with unlimited users included in every plan and pricing that fits SMB and mid-market budgets. Our pricing scales with contract volume, not headcount, keeping our CLM accessible and usable for growing teams. For organizations that want enterprise-grade features without enterprise-level cost, this keeps pricing predictable as the organization grows.

Not sure you have a full business case? ContractSafe’s ROI calculator helps quantify expected impact using real inputs.

Key Takeaways

-

Contract management directly impacts financial performance across renewals, revenue cycles, compliance exposure, and operational efficiency.

-

Manual processes lead to measurable contract value leakage through missed renewals, unmanaged obligations, and slow approvals.

-

Centralizing contracts reduces vendor overlap, strengthens negotiation leverage, and increases visibility across departments.

-

Automation (alerts, templates, workflows) eliminates preventable overspend and accelerates time-to-revenue.

-

AI-powered search and summaries reduce dependency on Legal and decrease internal and external billable hours.

-

A modern CMS influences the entire contract lifecycle, improving outcomes from creation to renewal.

-

ContractSafe provides a predictable, affordable path to enterprise-grade financial impact without the complexity or cost of traditional CLM platforms.

-

Stronger compliance controls reduce compliance-driven financial exposure and improve audit readiness.

Contract management isn’t just paperwork; it’s a financial system that directly impacts spend, revenue, and risk. With centralized contracts, automated alerts, and AI-powered visibility, ContractSafe helps teams prevent overspend, avoid renewal surprises, and capture measurable ROI—without the complexity of other CLM platforms.

If you’re ready to build a contract process that pays for itself, ContractSafe is the easiest way to get started.

Mini Glossary of Financial Terms

Cost Avoidance: Preventing unnecessary spend such as penalties, price escalations, or unplanned renewals.

Cost Reduction: Lowering current spend through better negotiations, vendor consolidation, or improved contract visibility.

Cost Recovery: Identifying money owed back to the organization, such as SLA credits, discounts, or billing corrections.

Accrual Timing: How contract execution dates and delays impact recognized revenue and expenses.

Total Cost of Ownership (TCO): The true cost of contract management, including labor, software, duplication of effort, and inefficiencies.

Value Leakage: Lost financial value caused by missed renewal opportunities, slow contracting cycles, unmanaged obligations, or lack of visibility.

Ready to unlock measurable ROI, reduce legal costs, and end renewal surprises?

👉 Request a quick, no obligation ConractSafe demo, today!

FAQs

How does contract management software reduce legal consultation and outside counsel costs?

It reduces cost by cutting the repetitive work that triggers legal involvement: hunting for executed agreements, reconstructing amendment history, answering routine questions (“what’s the notice period?”), and reviewing the same terms over and over. Industry reports estimate that businesses lose $122 per hour for every in-house lawyer working on a contract, based on salary estimations. The longer a contract takes, the higher the financial burden on legal departments. Centralized storage plus fast search, templates, and clean version history means internal teams can self-serve more answers, and Legal can spend less time on administrative lookups, reducing internal burn and outside counsel hours tied to document retrieval and audit prep.

How does centralized contract management prevent overspend and missed renewals?

Centralization creates renewal visibility + alerts so notice windows and renewal dates aren’t dependent on someone’s memory or a spreadsheet that may not be current.

When teams see renewals early, they can: renegotiate before auto-renewal triggers, avoid unwanted term extensions, and catch pricing escalators before they quietly apply. The financial value here is foundational: high-confidence visibility into dates and terms, not prediction.

How can contract software accelerate revenue and shorten contract cycles?

By reducing the common friction points: unclear ownership, manual routing, “which version is final?” confusion, and signature delays.

Approval workflows and e-signature reduce time spent waiting, while version control and standardized language reduce negotiation back-and-forth.

The result is fewer stalled deals and faster execution, so revenue can be recognized sooner.

What financial risks come from managing contracts in spreadsheets or shared drives?

The biggest risk is invisible exposure: missed renewals, missed termination windows, unmanaged escalators, and obligations that aren’t tracked until they become a problem. Spreadsheets also increase the odds of errors (wrong dates, outdated versions, incomplete amendment history).

During audits or disputes, the cost shows up fast: time lost searching, higher legal spend recreating documentation, and weaker defensibility when you can’t prove what was agreed and when.

How does better contract visibility improve vendor negotiation leverage?

Negotiation leverage improves when you walk into renewal conversations with facts: renewal dates, notice periods, escalator language, termination windows, contract value terms, and what you agreed to last time.

Better visibility also helps procurement and finance compare vendors side-by-side and identify overlaps across departments.

You’re no longer negotiating from memory; you’re negotiating from the contract.

Why is ContractSafe a more cost-effective way to achieve ROI compared to larger CLM platforms?

Because it focuses on the core ROI drivers without the overhead that slows adoption: centralized contracts, validated metadata, search, alerts, audit trails, and practical workflow support, delivered with a simpler rollout and predictable pricing.

ContractSafe’s value is in making contract data usable quickly (and broadly) so teams can prevent renewal surprises, reduce manual work, and support audits without paying for complexity they won’t use.

What’s the difference between cost avoidance and cost reduction in contract management?

Cost avoidance is preventing spend that would have happened (for example: catching an auto-renewal before it triggers, avoiding an escalator, preventing a penalty tied to a missed obligation).

Cost reduction is lowering spend you’re already committed to (for example: consolidating redundant vendors, renegotiating pricing based on better visibility, reducing outside counsel hours through faster retrieval and audit readiness).