Today's organizations work with more vendors than ever; many offering overlapping services or tools. When contracts are scattered across folders, inboxes, and departments, it becomes nearly impossible to track renewals, identify redundancies or understand where spend is being duplicated.

A simple vendor audit can reveal savings, reduce risk and give procurement and operations teams the clarity they need to make smarter, more cost-effective decisions.

- Vendor contract audits uncover hidden spend, duplicate tools, and compliance risks that organizations struggle to detect with a contract management solution

- Vendor optimization can be broken down into three steps: audit, evaluate and optimize

- Contract management software like ContractSafe can help businesses streamline operations and identify growth opportunities.

What is Vendor Contract Management?

Vendor contract management is the end-to-end process of creating, negotiating, storing, monitoring, and renewing the contracts you have with third-party vendors.

Done well, vendor contract management gives Procurement, Legal, Finance, and Operations a shared view of:

- What vendors you use and who approved them

- What terms you negotiated and what you're entitled to under the contract

- What you're paying including hidden fields and escalators

- What risks or compliance obligations exist

- How vendors are performing against commitments

- When contracts renew and how to avoid surprise auto-renewals

Most organizations struggle not because they have too many vendors but because there's no consistent process to review vendor contracts. Agreements are scattered across inboxes and shared drives, nobody has the full picture, and renewal dates slip through the cracks until an unexpected invoice arrives.

Strong vendor contract management fixes that.

The Vendor Contract Management Process At a Glance

Even though vendor relationships vary, most organizations follow a predictable lifecycle. Understanding the vendor contract lifecycle helps you identify where inefficiencies, risk, and unnecessary spend tend to hide.

The vendor contract lifecycle:

- Vendor due diligence & evaluation. Before drafting any contract, assess whether this vendor meets your requirements: security reviews, financial stability, checks, data-handling capabilities, third-party risk management (TPRM), and verification of certificates (SOC 2, ISO, industry-specific compliance)

- Legal & business review. Stakeholders across Legal, Procurement, Finance, IT/Security, and business owners review terms to ensure the contract protects company interests and meets operational requirements.

- Approval workflows. Route contracts through the appropriate approval chain based on contract value, risk level, and vendor type. Ideally this is done through automated workflows, not 47 forwarded emails.

- Execution & Storage. Sign the contract (via e-signature or wet signature) and store it in a centralized, searchable repository, not scattered across inboxes and departmental shared drives.

- Performance & obligation tracking. Monitor vendor performance against contractual commitments: SLA compliance, delivery timelines, support response times, and any other obligations spelled out in the contract.

- Renewal, renegotiation, or termination. Before contracts renew, evaluate whether to continue the relationship as-is, renegotiate better terms, rightsize the scope, or terminate and fine an alternative.

This guide focuses on stages 4-6; the post-signature phase where organizations see the greatest impact from auditing, evaluating, and optimizing their vendor landscape.

Why Vendor Visibility Matters More Than Ever

In today's SaaS-heavy, vendor-dense environment, visibility is the difference between overspending and staying in control.

Here's the core problem. Most organizations don't lose money because their vendors are expensive. They lose money because their vendor relationships are scattered across inboxes, owned by different departments, and never centrally reviewed.

When contracts are scattered, even well-intentioned teams lose track of upcoming renewals, overlapping subscriptions, and rising costs.

What are the biggest vendor visibility problems?

Here are the measurable problems business leaders face:

- According to World Commerce & Contracting, 49% of organizations fail to track at least some contracts, leading to surprise renewals and missed cancellation windows.

- Companies waste 35 to 50% of their SaaS spend on unused or underused licenses

- Companies have an average of 106 SaaS apps

- Tail spend (unmanaged, small vendors) make up about 10-20% of total spend while accounting for 80-90% of the items purchased.

A structured vendor audit brings clarity, uncovering savings, reducing risk, and strengthening negotiation leverage before the next renewal cycle hits.

The Risks of Poor Vendor Contract Management

Without a centralized, structured approach to vendor contracts, small issues compound into financial and operational risk.

- Missed renewals and surprise auto renewals. Contract renew automatically often at higher rates or with locked in terms

- Overlapping tools or duplicate solutions. Marketing buys their own project management tool, IT buys another. Operations picks a third. Nobody realizes all three do essentially the same thing.

- Unused or underused licenses. The silent killer of SaaS budgets. You're paying for 100 seats when only 60 people have logged in this year.

- Non-compliant or outdated data-processing terms. Your vendor's DPA was drafted in 2018, pre-CCPA. That's risky for privacy, security, and audit readiness

- No visibility into SLAs or vendor performance. Makes it impossible to hold vendors accountable for uptime, support quality, or the service levels they contractually promised.

- Unclear ownership. Nobody knows who "owns" the vendor relationship or who's responsible for reviewing it before renewal. So nobody does.

- Hard-to-answer audit questions. "How much do we spend with this vendor?" shouldn't require a scavenger hunt through three years of invoices and departmental credit card statements.

Key Insight: These problems compound over time, which is why a structured audit process delivers such fast returns. You're not just finding immediate savings, you're preventing future issues.

The good news? Mot of these issues are fixable with a systematic approach.

You don't need to solve everything at once. Start by getting visibility into what you actually have. Once you can see your full vendor landscape, you can make informed decisions about which relationships to keep, which to renegotiate, and which to end.

The following three-step framework give you a repeatable process for taking control of vendor spend and risk.

Step 1: How to Audit Your Vendor Contracts

A vendor audit is like turning the lights on in a cluttered room. You suddenly see what's actually there. Step 1 is about gathering a complete picture of your vendor ecosystem so you can make informed decisions instead of guessing.

How do I know if we're overspending on vendors?

The only way to manage vendor relationships effectively is to know what you have. Now what you think you have, but the reality scattered across your organization.

You start by pulling every contract, invoice, and renewal data into one place.

Centralize all vendor contracts

Once you know the goal (which is to bring everything into one place), the next challenge is actually finding it all. Most organizations quickly realize their vendor contracts aren't neatly stored in a single folder. They're scattered across teams, inboxes, shared drives, and systems nobody remembers setting up.

This part of the audit requires detective work. Here's where to look:

- Email inboxes for signed MSAs and SOWs (search for "signed," "executed," "final," attachment:pdf)

- Departmental shared drives where older versions or amendments may be buried

- Physical binders in office managers' filing cabinets (yes, it's still a thing)

- Accounts Payable records to reverse-engineer which vendors you're actively paying

- Departmental head interviews to confirm which tools, subscriptions, and services they're actually using today

As you gather documents, organize and centralize everything in one searchable repository:

| Document Type | Examples |

|---|---|

| Agreements | MSAs, SOWs, amendments, addendums |

| Licensing | Software licenses, usage reports, seat counts |

| Financial | Invoices, POs, payment schedules |

| Compliance | Insurance certificates, security documents, data-handling terms |

| Operational | Equipment leases, maintenance contracts, consulting agreements |

| Renewals | Renewal reminders, auto-renewal notices |

Identify Duplicate Vendors and Tools

Now compare what you found. This is where duplicate spending and redundant services become obvious

- Interview stakeholders by department. Ask what services and tools they're using, why they chose those vendors, and whether alternatives exist internally.

- Compare what you're paying for versus what's actually being used. For software, that may mean reviewing active user counts vs contracted licenses. For service providers, compare hours worked vs hours billed. for equipment or facilities vendors, review usage logs, service activity or maintenance performance.

- Map your vendor relationships by category (legal services, facilities, technology, professional services, supplies, equipment) and by department (Marketing, IT, Operations, HR). This overlap becomes obvious once everything is laid out.

- Categorize tools and services by function to uncover where multiple departments have purchased similar solutions independently.

What contract information should I track?

Some contracts come with all the details you need. Many don't. As you audit, flag which critical information is missing or unclear.

Key fields to extract in every vendor audit:

| Contract Field | Why It Matters |

|---|---|

| Renewal dates/ notice periods | 30, 60, or 90 days required to opt out? |

| Auto-renewal terms | Does silence mean automatic extension? |

| Termination | Early exit fees, wind-down requirements, data export costs |

| Total contract value | Include all fees, usage caps, and rate escalators |

| Payment terms | Monthly, milestone-based? |

| Security requirements | SOC2, ISO certificates, background checks, BAAs |

| SLA commitments | Response times, uptime guarantees, performance standards |

| dependencies | What breaks if this vendor goes away |

| Data-privacy obligations | Retention rules, breach notification timelines, international transfers |

| Contract owner | Who's responsible for managing this relationship |

Audit Reality Check: If you're finding contracts where you can't identify the owner, the renewal date, or even the total annual cost, you're not alone. That's exactly why this audit matters. Missing information creates risk. If you don't know when contracts renew, you can't plan for renegotiation. If you don't know termination fees, you can't accurately calculate whether switching vendors makes financial sense.

Step 2: How to Evaluate Vendors with Clear, Repeatable Criteria

Once you know what you have, the next challenge is understanding whether each vendor relationship delivers enough value to justify the cost and risk.

Evaluation only works when your criteria are consistent and repeatable. Otherwise, you're just making gut-level decisions.

How do I evaluate whether a vendor is worth keeping?

You need to evaluate four dimensions: cost, risk, performance, and strategic fit. Here's how to assess each one.

Calculate the true Total Cost of Relationship (TCR)

Costs goes far beyond sticker price. to evaluate any vendor, whether they provide software, services, equipment, maintenance, or professional support, you need a full picture of what the relationship actually costs your organization.

Direct Vendor Costs

- Base contract costs: licenses, service fees, hourly billing, equipment rentals, maintenance plans

- Add-on modules, premium features, or extended services

- Support tiers or service-level upgrades

- Rate escalators or built-in price increases

Implementation & Onboarding

- Training, onboarding, or ramp-up time

- Internal hours spent getting the vendor operational

- Integration, setup, or implementation costs (applies to software and non-software vendors)

Hidden & Variable Costs

- Usage-based fees (storage, per-transaction costs, excess maintenance requests)

- Rush fees, expedited delivery charges, after-hour premiums

- Shadow spend across departments where different teams pay for the same vendor or buy supplemental services independently

Indirect Costs:

- Staff time managing the vendor relationship

- Inefficiencies, extended timelines, or repeated work due to performance issues

Evaluate Compliance & Risk Exposure

Every vendor introduces some level of risk whether its operational, financial, regulatory, cybersecurity, or reputational. A thorough vendor assessment should reflect the type of service provided.

Check for risk and compliance considerations such as:

- Security obligations such as SOC , ISO, HIPAA, physical security measures, background checks for onsite vendors

- Data-access or data-handling terms, even for non-software vendors who interact with customer, patient or employee information

- Privacy and confidentiality requirements, including NDAs or data sharing limits

- Insurance coverage, such as liability, E&O, workers' comp for onsite contractors

- Indemnification clauses and liability caps

- Service delivery obligations, like uptime SLAs, response times, maintenance schedules, staffing levels or performance guarantees

- Regulatory requirements, including BAAs (for healthcare), PCI (for payment vendors), OSHA or safety standards (for equipment/facilities vendors), or industry-specific certifications

- Incident or breach notification timelines applies to both data breaches and service-impacting incidents

- Audit rights and reporting requirements, including the ability to verify compliance or inspect performance

- Subcontractor usage, which can introduce hidden risk if third parties support the vendor's work

The key is to evaluate risk proportionally: the more critical or sensitive the vendor's work is, the deeper the review should go.

Assess SLA Performance and Support

Service Level Agreements (SLAs) outline what a vendor has committed to: response times, uptime, delivery schedules, maintenance cycles, and support quality.

But simply having SLAs in a contract doesn't guarantee they're being met. Evaluating SLA performance helps you understand whether the vendor is reliable and whether their performance is causing delays, service disruptions, or hidden costs across your organizations.

How do I know if SLAs are being met?

Use a mix of internal and external indicators:

For software & technology vendors:

- Ticketing logs or service requests histories

- Uptime dashboards or availability metrics

- Incident reports, outage summaries, root cause analyses

- Vendor-provided performance summaries (but verify them independently)

For service & consulting vendors:

- Project delivery timelines vs. promised dates

- Response time to requests

- Quality of deliverables against contract specifications

- Stakeholder satisfaction surveys

For equipment, maintenance, or facilities vendors

- On-site service completion rates

- Maintenance cycle adherence

- Equipment downtime or failure rates

- Emergency response times

SLA compliance rarely surfaces automatically. It requires cross-checking multiple sources to confirm whether performance matches what the contract guarantees.

Evaluate Strategic Fit

A vendor that was ideal three years ago may not be the right fit today. Business priorities shift. Teams reorganize. New tools or service providers enter the market. And as your organization grows, what felt "good enough" at 20 employees might become a bottleneck at 200.

Ask these questions:

- Does this vendor still support the organizations' current goals and priorities?

- Has the organization outgrown this vendor or solution?

- Is this vendor integrated into critical systems or processes (meaning high switching costs)?

- Does actual usage justify the ongoing cost?

- Could an existing internal capability replace this vendor?

- Are employees consistently using and adopting this service, or working around it?

- Is there a better alternative available now that didn't exist when we first signed?

Vendors that underperform across cost, risk, performance, and strategic fit become clear candidates for optimization in Step 3.

Step 3: How to Consolidate, Renegotiate, or Terminate Vendors

Now you turn audit data into action.

Optimization isn't about cutting vendors blindly; it's about aligning spend, performance, and organizational goals

How do I compare vendor contracts side by side?

Once you've evaluated your vendors against consistent criteria, patterns emerge. Some vendors clearly deliver values. Others clearly don't. Many fall. somewhere in between and need a closer look.

This is where you make strategic decisions: which vendors to consolidate, which contracts to renegotiate, and which relationships to end.

3A. When should I consolidate vendors?

Consolidation is one of the fastest ways to reduce spend and simplify operations. When teams purchase tools independently or accumulate vendor sprawl over time, overlapping functionality becomes inevitable.

Consolidating vendors brings complexity back under control and often unlocks meaningful savings

You may want to consolidate vendors when:

- Multiple tools accomplish the same job, even if they're used by different teams

- Similar modules or overlapping services exist across contracts

- Departments independently purchase their own solutions without shared visibility

- Vendor management overhead exceeds the value of having choice

How do I manage the transition when consolidating vendors?

Consolidation affects workflows, integrations, and institutional knowledge, so thoughtful planning matters.

Before making changes:

- Communicate early with teams that rely on the vendor

- Involve cross-functional stakeholders in selecting the replacement provider

- Build a clear transition plan with timelines and milestones

- Provide training and onboarding support for the new system

- Give teams time to adapt, especially if integrations or processes will change

- Assign a transition owner who's responsible for managing the consolidating project

Done right, consolidation delivers both cost savings and simplified vendor management: fewer contracts to track, fewer invoices to process, and stronger partnerships with the vendors that remain.

3B. When should I renegotiate a vendor contract?

Some vendors are clear keepers; they deliver value, meet SLAs, and support your operations. But the contract structure doesn't always match your actual needs.

That's where renegotiation becomes powerful. When you come prepared with real data about usage, performance, and spend, you gain leverage to negotiate better terms, lower costs, or get more favorable commitments.

Renegotiate when:

- The vendor delivers necessary value but the terms needs improvement

- Pricing is too high relative to actual usage

- SLAs are weak or don't match current needs

- The contract structure doesn't match usage patterns (paying for 100 seats but only using 60)

- You have competitive alternatives and can use them as leverage

With your audit data in hand, use it to negotiate:

- Lower per-seat or per-service pricing based on actual usage

- Rightsizing license counts or service hours to match reality

- Stronger SLAs or guaranteed response times with clear remedies for non-performance

- Bundled modules, added services, or upgraded features

- Volume discounts or multi-year incentives if you're committing longer

- Removal of unnecessary fees such as training, support tiers, maintenance add-ons

- Better payment terms (net-30 instead of net-15 or post-pay vs pre-pay)

- Better termination terms (shorter notice periods, lower early exit fees)

Negotiation Pro Tip: The best time to renegotiate is 90-120 days before renewal. you have leverage (you can still walk away), and vendors are motivated to keep the relationship rather than lose you to a competitor. Strong data signals that you're informed, reasonable, and willing to optimize. All this makes vendors more flexible at the negotiating table.

3C. When should I terminate a vendor relationship?

Terminate a vendor that is no longer adding value, Sometimes the smartest vendor decision isn't renegotiation, it's letting the relationship go,

Terminating a vendor can feel daunting, especially if "we've always used them" or someone on the teams loves the tool. But when usage is low or the product no longer aligns with your operational priorities, ending the relationship protects both budget and team bandwidth.

You may want to end a vendor relationship when:

- Usage is consistently low, even after reasonable adoption efforts

- Vendor performance is unreliable, or the tool frequently disrupts workflows

- The service is no longer strategically important to your business

- Internal tools or existing platforms can replace it with minimal disruption

- The cost-benefit equation doesn't hold up anymore, especially if renewal terms escalate

- The vendor presents ongoing compliance or security risks you can't mitigate.

What do I need to check before terminating a vendor?

Before canceling, review the contract for:

- Early termination fees that may affect timing (sometimes it's cheaper to wait until renewal)

- Required notice periods (30, 60, 90 days or more)

- Migration or data export costs that could require additional budget

- Transition assistance commitments. Some vendors must provide support during wind down

- Data retention and deletion policies. How long do they keep your data, and how do you ensure it's deleted.

Finally consider operational impact. Which workflows depend on the vendor today? Who will own the transition project? Mapping responsibilities in advance ensures the sunset is smooth rather than chaotic.

Terminating a vendor isn't just subtraction; it's a chance to redirect resources towards tools and partnerships that truly move your organization forward.

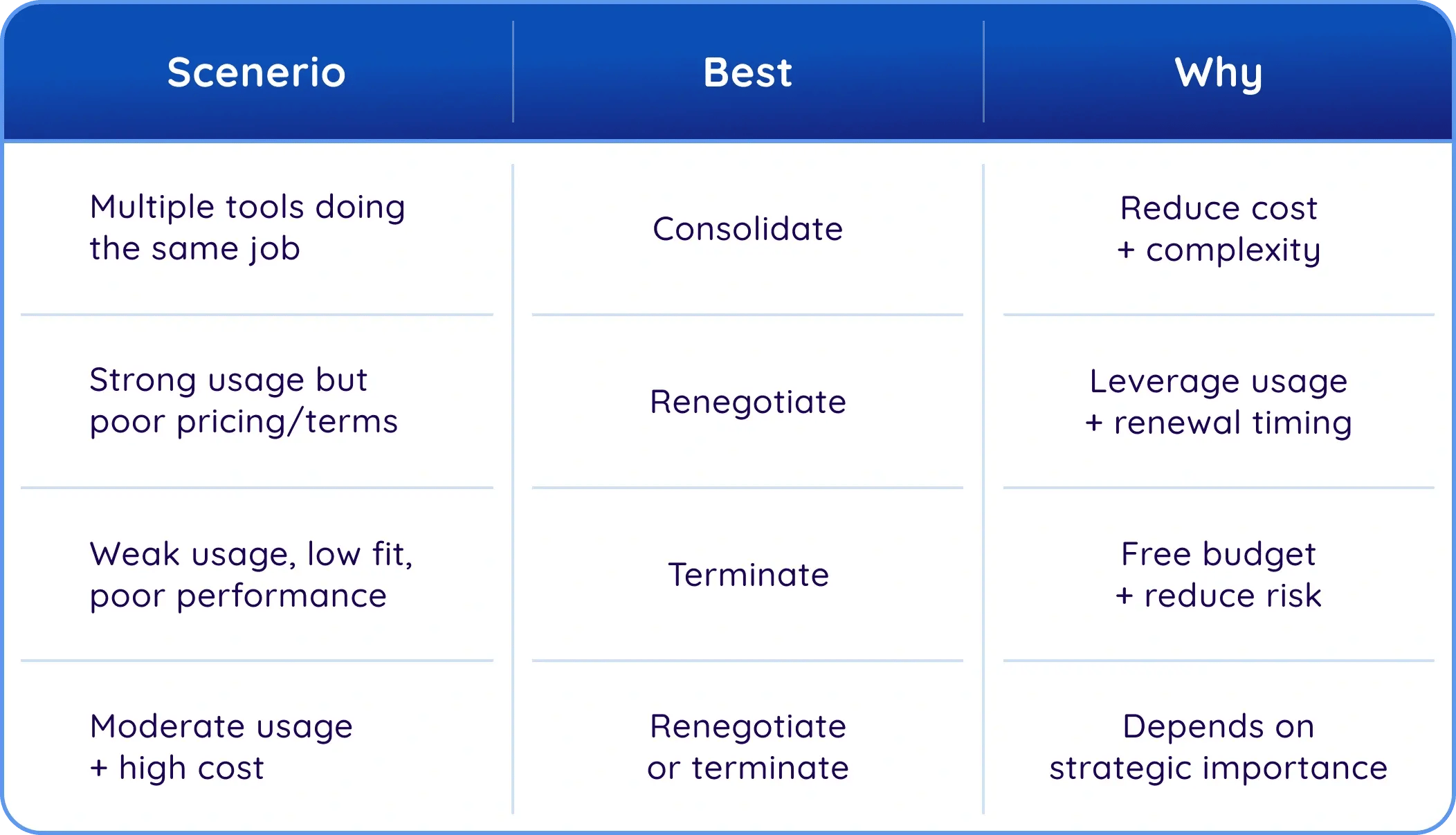

3D. Decision Guide: When to Consolidate, Renegotiate, or Terminate

Once you've assessed cost, performance, and risk, the next step is deciding what to do with each vendor. This simple framework helps teams apply consistent logic across the portfolio so decision are based on data, not gut feel.

The decision-making structure keeps vendor optimization objective and ensure teams prioritize vendors that deliver real operational and financial value.

How Software Supports Vendor Contract Management

Modern vendor landscapes move too quickly for teams to rely on spreadsheets, inbox searches or institutional memory.

Software creates the structure that keeps Procurement, Legal, Finance and Operations aligned before and after a contract is signed. The right platform gives teams clarity and turns vendor management into a repeatable, data-driven process.

What does vendor contract management software do?

Vendor contract management software centralizes all vendor contracts in one secure, searchable system and automates the full contract lifecycle--from creation and approval workflows through storage, monitoring, and renewal tracking.

It gives teams shared visibility into what vendors you have, what you're paying, when contracts renew, and whether vendors are meeting their commitments.

The software handles two critical phases:

Post-Signature Capabilities (what most people think of):

- Centralizes every vendor contract - MSAs, SOWs, DPAs, BAAs, amendments, pricing schedules, security attachments in one searchable repository.

- Surfaces critical terms instantly - Renewal dates, notice period, SLAs, pricing structures, jurisdiction

- Automates alerts & reminders - Never miss a renewal window, especially when notice periods are buried in legalese

- Improves cross-department collaboration - Procurement, Legal, IT, Finance and Operations work from the same shared system

- Provides contract-type visibility - identify overlap in services and redundant spend

- Streamlines audits & reporting - Get fast answers to: "What is the termination notice period?", "What SaaS contracts are expiring next quarter?"

Pre-signature Workflow Support:

Software doesn't just help once a vendor contract is signed. It also brings structure to the steps that happen before an agreement is executed. These pre-signature workflows are where many delays, risks, and inconsistencies originate.

- Templates standardize vendor agreements with consistent terms and risk controls.

- Approval Workflows route agreements to the right people without having to chase them in email

- Integrated e-signatures eliminates back-and-forth and reduced turnaround time

- Version Control and comment trails show exactly what changed, why and by whom

With the right software in place, vendor management becomes predictable, not reactive. Teams gain confidence and clarity needed to optimize pend, reduce risk, and strengthen vendor relationships.

How ContractSafe Supports Vendor Audits

When vendor audits come around—whether internal, external, or compliance-driven—ContractSafe gives you the answers you need in minutes, not days.

ContractSafe centralizes all vendor contracts in one secure, searchable repository with AI-powered data extraction, AI chat, and natural language search so you can surface critical contract terms and spot duplicate vendors instantly.

Set automated renewal reminders so you never miss another deadline to non-renew or auto-renewal date. With unlimited users on all plans, anyone who needs to be "in the know" can access the information they need.

Fast implementation means you can import contracts, extract data, and start auditing in hours, not months

With centralized data and streamlined workflows, teams spend less time hunting for information and more time improving vendor performance, negotiating better terms, and reducing unnecessary spend.

Book a demo to see how ContractSafe can transform your vendor contract management process.