By adopting a strategic approach to contract audits, businesses can unlock a wealth of insights that streamline contract management processes, cut costs, and foster stronger partnerships.

The word “audit” doesn’t have a great rep. It’s usually followed by something like, “And the IRS says you owe them money.”

But did you know that audits can actually be an ally?

If you're proactive, contract audits are amazing for identifying opportunities for improvement, mitigating risks, and enhancing operational efficiency.

Plus, if you have to deal with a surprise audit, you can rest assured that you’re as prepared as possible.

Table of Contents:

- What Is a Contract Audit?

- Preparing for a Contract Audit

- 7 Best Practices for Conducting Contract Audits

- Implementing Changes and Monitoring Progress

- How ContractSafe Makes Contract Audits Easier

- FAQs

TL;DR

- A contract audit is a deep dive into your business’s agreements, ensuring they're working for you, not against you.

- Audits are important for maintaining compliance, uncovering cost-saving opportunities, and enhancing operational efficiency.

- Contract management software like ContractSafe streamlines this process, making it easier to stay prepared and proactive.

What Is a Contract Audit?

A contract audit is a thorough examination of the processes and agreements related to contracts within an organization. This scrutiny ensures that every contract is managed correctly, efficiently, and in alignment with both internal policies and external regulations.

A contract audit can be proactive or reactive.

Proactive contract audits are scheduled with foresight and strategy in mind. They are not about putting out fires but preventing them.

By regularly reviewing contracts and their management processes, organizations can identify potential issues before they arise, streamline operations, and ensure ongoing compliance with evolving regulations.

Proactive audits embody the adage, "An ounce of prevention is worth a pound of cure," focusing on continuous improvement and risk mitigation.

Reactive contract audits, on the other hand, are typically initiated when a specific issue or discrepancy comes to light. Maybe it’s a payment that doesn’t align with the terms outlined in a contract or perhaps a service level agreement (SLA) isn’t being met.

Reactive audits dive deep into these concerns, aiming to resolve them quickly and effectively. While necessary, they often serve as a wake-up call to underlying problems in contract management processes that you may have overlooked.

In both cases, the aim is to provide assurance that contracts are executed and managed in a way that maximizes efficiency, minimizes risk, and aligns with the organization's strategic goals.

Whether responding to an immediate issue or strategically planning to avoid future ones, contract audits are an indispensable tool in the arsenal of effective contract management.

Why Contract Audits Are Important

Contract audits are key in ensuring the health and compliance of your organization's contract portfolio and also contribute to its strategic and financial strength. Research from trusted industry sources underscores why visibility and review matter:

- 61% of organizations lack complete visibility into their contract portfolio (World Commerce & Contracting).

- Organizations lose an average of 9% of annual revenue due to poor contract management practices (Procurement Tactics).

Together, these findi

Together, these findings highlight why visibility, regular review, and structured oversight aren’t optional — they’re foundational.

Contract audits give decision-makers the clarity they need to navigate complex obligations, eliminate blind spots, and strengthen day-to-day operations. Here’s what makes them so valuable:

ngs highlight why visibility, regular review, and structured oversight aren’t optional — they’re foundational.

Contract audits give decision-makers the clarity they need to navigate complex obligations, eliminate blind spots, and strengthen day-to-day operations. Here’s what makes them so valuable:

- Ensure compliance: Navigating laws and regulations can be tough. Contract audits help ensure your contracts follow these rules, avoiding potential legal issues and fines.

- Identify cost savings: Audits can show you where you might be spending too much or not getting what you were promised. This can help you save money by renegotiating terms or cutting unnecessary costs.

- Mitigate risks: Spotting issues early in your contracts can prevent bigger problems later on. This means you can fix things before they lead to financial loss or legal troubles.

- Enhance efficiency: Looking at how you manage contracts can help you find slow or outdated processes. Improving these can make your contract management smoother and more efficient.

- Improve relationships with counterparties: Regular checks ensure everyone is sticking to their side of the deal. This builds trust and can make working together easier and more productive.

- Support strategic decision-making: Understanding your contracts better can help you make smarter business decisions. You'll know where you stand, what needs attention, and where growth opportunities exist.

In short, contract audits help make sure your contracts are working for you, not against you. They help your business stay ahead of problems, save money, and make better decisions.

Types of Contract Audits

Understanding the different types of contract audits can help you tailor your approach to meet your specific needs.

While some audits focus on individual contracts, a comprehensive strategy involves examining your entire contract database to ensure consistency, compliance, and efficiency across the board.

Here’s a closer look at the various types of contract audits:

- Financial audits: These audits delve into the financial aspects of your contracts. These audits can highlight systemic issues in billing practices or uncover opportunities for renegotiating terms across multiple contracts.

- Performance audits: This type involves assessing the outcomes and services delivered under contracts against what was agreed upon. A performance audit can help identify patterns of underperformance or noncompliance, leading to broader operational improvements.

- Compliance audits: These audits ensure that your contracts adhere to relevant laws, regulations, and internal policies. A comprehensive compliance audit helps protect your organization from legal risks and penalties, ensuring that all contracts meet regulatory standards.

- Contract closeout audits: Conducted at the end of a contract's lifecycle, these audits verify that all terms have been met and that there are no outstanding obligations. Closeout audits can ensure that old contracts are properly concluded, preventing lingering liabilities.

- Contract management audits: These audits review how contracts are managed from creation to closeout. By examining your contract management processes, you can identify inefficiencies and implement improvements that benefit all future contracts.

Each type of contract audit plays a unique role in ensuring you manage contracts effectively, minimize risks, and meet the organization's objectives.

RELATED READ: How to Audit Contracts for 5 Critical Clauses

Preparing for a Contract Audit

Preparation is key to a successful contract audit. Whether you're gearing up for a proactive or reactive audit, having a well-thought-out plan can make the process smoother and more effective.

- Gather every relevant contract and supporting documents, including amendments, extensions, and related correspondence. Having all these documents on hand is the foundation of your audit, ensuring nothing gets overlooked.

- Prioritize contracts based on their value, risk, and strategic importance to your organization. Not every contract needs the same level of attention. Focus on those that have the greatest impact on your operations and objectives.

- Familiarize yourself with any legal or industry-specific regulations that impact your contracts. Knowledge of these regulations is crucial for ensuring your contracts are compliant and can help guide your audit's focus areas.

- Determine a realistic timeline for your audit, considering the availability of key personnel and resources. Be mindful that some audits are mandated and might not offer flexibility in scheduling.

- Regular internal audits can help keep your organization in a constant state of readiness, easing the pressure when external audits are announced.

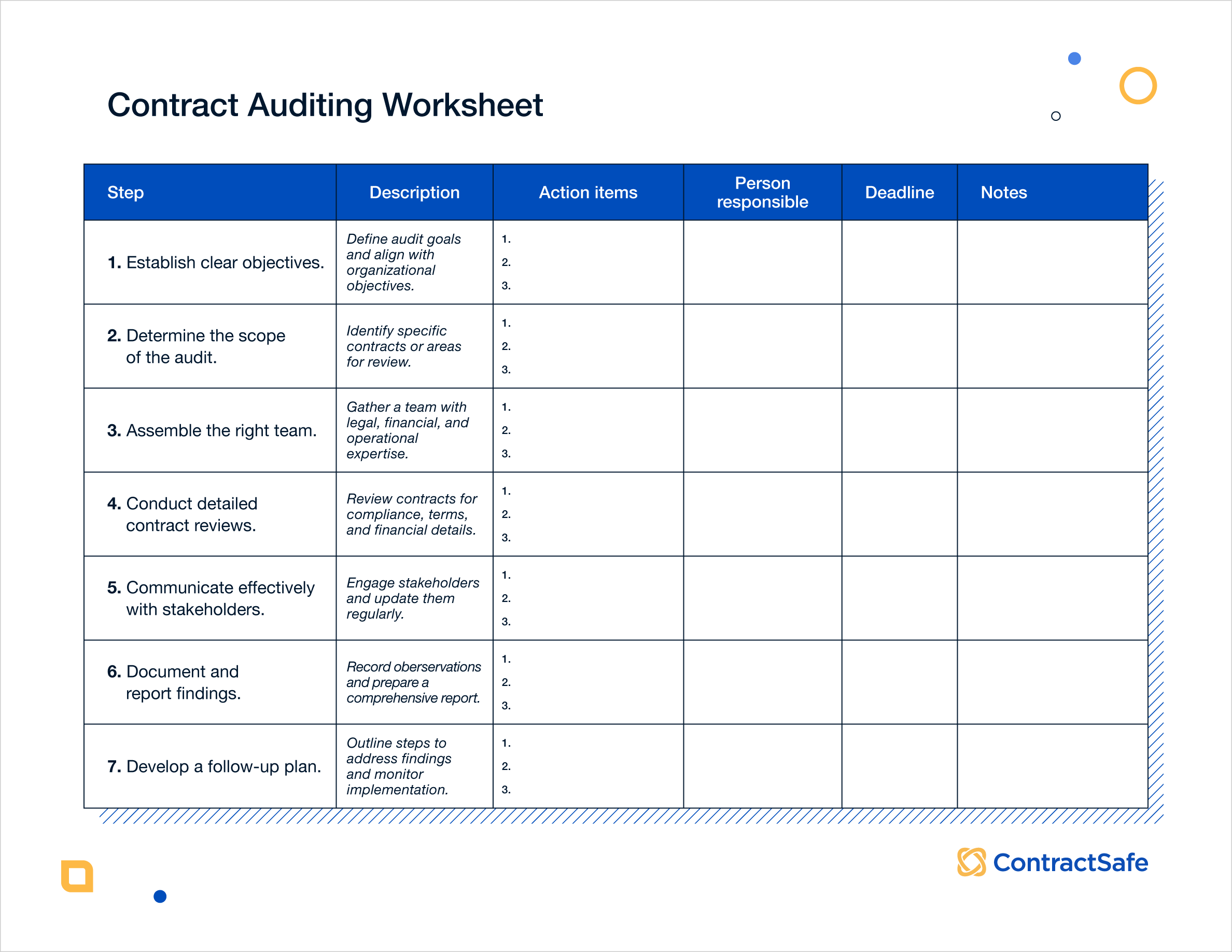

7 Best Practices for Conducting Contract Audits

Before diving into the details, it's essential to understand that successful contract audits are built on a foundation of clear planning and strategic execution.

These seven best practices are designed to guide you through the audit process, ensuring thoroughness and efficiency every step of the way.

1. Establish Clear Objectives

Before you start an audit, it's important to define what you hope to achieve.

Aligning your audit objectives with your organization's strategic goals will guarantee that the audit adds true value. You’ll also want to set measurable outcomes so you can evaluate the audit's effectiveness once it's completed.

If your goal is to reduce costs, for example, you might identify specific contracts that are over budget by a certain percentage or look for areas where service delivery does not match the payment terms, leading to renegotiations or adjustments.

Or, if your goal is to improve compliance, you should ensure all contracts comply with new regulatory standards or that all vendor agreements include updated data protection clauses in line with recent legislation.

By setting clear, specific objectives and identifying what success looks like for each, you pave the way for a focused and effective audit.

2. Determine the Scope of the Audit

Identifying the areas that need attention is a pivotal next step. This determination should be based on a mix of factors, including past issues, their monetary value, or how essential they are to your business's strategic objectives.

Maybe you've noticed a recurring issue with late deliveries from a particular supplier, or some contracts consistently exceed their budget allocations. These observations can help narrow down where to focus your auditing efforts.

Limiting the scope to manageable segments ensures that your audit can be both deep and thorough rather than broad and superficial.

It's about quality over quantity. This focused approach allows for a more detailed analysis, providing insights that might be lost in a wider audit scope.

3. Assemble the Right Team

For a contract audit to be truly effective, bringing together a diverse team with expertise in various areas is imperative. This multidisciplinary approach ensures a comprehensive review of the contracts from all necessary perspectives.

- Legal: If your objective is to improve compliance, a legal expert can provide insights into necessary adjustments to meet new regulatory standards.

- Financial: If reducing costs is your primary goal, a financial ace can identify overpayments or areas for renegotiation.

- Operational: If your goal includes enhancing operational efficiency, someone with a deep understanding of day-to-day operations and the types of contracts you’re using can pinpoint where service delivery might not align with the contract.

Ensure all team members are well versed in audit procedures and the specific objectives of the audit. This foundational knowledge, combined with their expertise, will guide their analysis and contributions.

4. Conduct Detailed Contract Reviews

The heart of the contract audit process lies in conducting detailed contract reviews. This stage is pivotal in uncovering discrepancies, ensuring alignment with business goals, and identifying areas for improvement.

.webp?width=1740&height=2053&name=contract-review-checklist%20(1).webp)

- Verify names and dates: Ensure all names, dates, and essential details are accurate and current. This includes the correct legal names of the entities involved, contract start and end dates, and any significant milestones or deadlines.

- Review terms, conditions, and deliverables: Check that the contract's terms and conditions and the deliverables are in full alignment with your business objectives.

- Examine fees, payment schedules, and penalties: Confirm that all financial aspects, such as fees, payment schedules, due dates, and any penalties for late payments or breaches, are clearly outlined.

- Assess obligations and timelines: Make sure all obligations of both parties, along with the timelines for those obligations, are clearly defined and consistent with any prior discussions, agreements, or reference documents.

Following these steps during the review will help identify any potential issues that could affect the performance or compliance of the contract. It also sets the stage for renegotiations or adjustments necessary to align the contract more closely with your organization's needs and goals.

You may also consider using AI to help with a contract review. But remember, a human should always have the last say!

5. Communicate Effectively With Stakeholders

Effective communication is key to the success of any contract audit.

It's important to engage with stakeholders from the beginning, understanding their perspectives and addressing any potential concerns. Early dialogue sets a cooperative tone for the audit, signaling a commitment to transparency and inclusivity.

As the audit progresses, providing stakeholders with regular updates is essential. Keeping them informed about both the audit's progress and any preliminary findings ensures there are no surprises at the end. It also allows for the early resolution of potential issues, maintaining a dynamic and responsive audit process.

Encouraging feedback and open discussions is another important aspect of effective communication.

Actively seeking out stakeholder input on the audit's findings and the process itself can lead to valuable insights, clarify any misunderstandings, and help address discrepancies efficiently.

This is much easier when using a cloud-based tool that allows you and other stakeholders to share information, add comments, and address errors directly within a document.

6. Document and Report Findings

Documenting and reporting the findings of a contract audit are steps you just can’t skip if you want your audit’s insights to lead to real change.

This means meticulously recording all observations, identifying discrepancies, and pinpointing areas for improvement.

This detailed documentation forms the basis of a comprehensive report that not only summarizes the audit findings but also outlines their implications and suggests recommended actions.

Once this report is prepared, it's important to present the findings to all relevant stakeholders in a clear and actionable manner.

The goal is to communicate the audit's outcomes effectively so stakeholders understand the findings, the potential impact on the organization, and the steps needed to address any issues uncovered.

By providing a clear path forward, the audit report becomes a tool for positive change, guiding the organization toward improved contract management practices.

7. Develop a Follow-Up Plan

After documenting and reporting the findings from a contract audit, the next essential step is to develop a robust follow-up plan.

This plan should clearly outline the steps necessary to address the audit's findings, assigning specific timelines for completion and designating responsibilities to provide accountability.

Establishing mechanisms for monitoring the implementation of these recommended changes is necessary. This could involve regular check-ins, progress reports, or using project management tools to track the advancements made toward rectifying the issues identified during the audit.

Finally, scheduling follow-up audits is a key component of the plan.

These audits are critical for assessing whether the implemented changes have effectively addressed the initial findings and ensuring ongoing compliance and continuous improvement.

Implementing Changes and Monitoring Progress

After an audit, you need to put changes into action and keep an eye on progress. This means turning audit insights into clear steps for improvement.

Here’s a simplified approach:

- Prioritize changes based on audit findings: Start by tackling the most urgent issues found during the audit, like big compliance gaps or overpayments. This helps manage contract risks and improve financial health right off the bat.

- Monitor the impact of implemented changes: Keep an eye on how these changes affect your operations. Are you saving money? Are processes running smoother? Keeping track helps make sure your efforts are paying off.

- Set up regular checks: Plan regular reviews to see how well the changes are working. This could be every few months or once a year. It's about making sure improvements last and keep aligning with your goals.

- Foster a culture of continuous improvement: Encourage your team to look for ways to improve. Learning from each audit can make your business even stronger over time.

- Use contract management software: Consider using software like ContractSafe. It can make tracking changes, managing compliance, and organizing contracts easier and more efficient.

By following these steps, you ensure the audit leads to real benefits for your contract management. It's about being proactive, staying compliant, and always aiming for better.

RELATED READ: Best Practices for Contract Redlining & Change Tracking in a CMS

Learn How ContractSafe Can Help You Ace Your Next Contract Audit

A strong contract audit depends on visibility, documentation accuracy, and fast access to information. ContractSafe gives your team all three — without the complexity of heavier enterprise systems.

Centralized Contract Repository

Every contract, amendment, BAA, SLA, and supporting document lives in one organized, searchable home. No inbox hunting. No file-version mystery.

OCR-Powered Search Across Every Document

ContractSafe converts scanned PDFs into searchable text, making it easy to find renewal dates, obligations, indemnity language, or notice periods instantly. For audit prep, this eliminates hours of manual digging.

AI Categorization & AI-Assisted Data Extraction

AI automatically recognizes contract types, assigns required fields, and helps surface missing metadata — making it easier to spot inconsistencies, incomplete records, or data gaps before an audit begins.

AI Contract Chat (“Ask Your Contracts”)

Need to know who can terminate? Which vendor has a 60-day notice period? What the liability cap is?

AI Contract Chat answers questions directly from the contract content, helping your team move faster during audit preparation and review.

Audit Trails for Every Contract

Track every action, change, review, and approval. Auditors get a complete history in seconds.

Roles & Permissions for Compliance

Set exactly who can view, edit, approve, or upload documents. This is essential for HIPAA, SOC 2, and other compliance-led audits.

Bulk Upload + Automatic Organization

Pull in large volumes of vendor or customer agreements and let ContractSafe help categorize, flag missing fields, and prepare your dataset for structured audits.

Reporting & Mini-Audits

Run exception reports to find missing data, expired insurance documents, untagged contracts, incomplete fields, or upcoming renewals that require attention — perfect for proactive audit cycles.

Approval Workflows Without the IT Overhead

Ensure every contract is vetted and documented consistently, creating clean, audit-ready records throughout the lifecycle.

Discover how ContractSafe can transform your contract audit process and bring your contract management to new heights.

Schedule a demo today and take the first step toward more efficient,

effective audit preparation and execution.

FAQ

What is a contract audit?

A contract audit is a structured review of contracts, obligations, financials, performance, and compliance to ensure agreements are being followed as written. Organizations perform contract audits to reduce risk, improve spend visibility, and uncover cost-saving opportunities.

What documents are required for a contract audit?

A contract audit requires collecting every document that proves what was agreed to, what has been delivered, and whether both sides have met their obligations. Most contract audits include:

-

The contract itself + all amendments, addendums, and extensions

-

Renewal notices and auto-renewal clauses

-

SLA / KPI performance logs

-

Invoices, payment records, credits, and billing adjustments

-

Compliance documentation (HIPAA BAAs, SOC 2 reports, ISO certifications, security questionnaires)

-

Change orders, scope adjustments, and relevant email correspondence

-

Internal approvals (redlines, version history, signature records)

These documents form the “audit evidence” needed to validate accuracy, performance, compliance, and financial integrity.

How often should businesses conduct contract audits?

Most organizations benefit from a structured contract audit cadence that aligns with contract risk and spend levels:

-

High-risk contracts (regulatory, financial, data-sensitive): Quarterly

-

Moderate-risk contracts (vendor, customer, key services): Twice per year

-

Full portfolio audit: Annually

Many teams also conduct event-based audits, such as when regulations change, a vendor underperforms, a dispute arises, or before major renewals. The key is consistency: regular reviews prevent missed obligations, surprise renewals, overspend, and compliance gaps.

What are common contract audit findings?

Contract audits routinely uncover issues that impact cost, compliance, and performance. Typical findings include:

-

Missed renewal deadlines, leading to unwanted auto-renewals or unfavorable terms

-

Pricing discrepancies between agreed rates and billed amounts

-

SLA or KPI non-performance, often documented inconsistently

-

Regulatory or policy gaps, especially when terms haven’t been updated for HIPAA, GDPR, SOC 2, ISO, or new industry requirements

-

Missing or incomplete documentation, such as absent BAAs, outdated certificates, or missing amendments

-

Incorrect metadata or missing required fields, which prevents accurate reporting and spend visibility

-

Unauthorized terms, version-control problems, or contracts executed without proper approvals

-

Scope creep, unapproved changes, or deliverables not matching the written agreement

These findings often reveal broader process issues and highlight opportunities for improvement.

How do you prepare for a contract audit?

Preparing for a contract audit starts with organizing all contract information in one place and confirming that documentation is complete. Best practices include:

-

Centralize every contract and related file in a contract repository or CMS

-

Prioritize high-value or high-risk agreements so you can audit the most important ones first

-

Compile financial evidence such as invoices, payment records, credits, and spend summaries

-

Gather performance documentation, including SLA logs, KPIs, and communications about deliverables

-

Verify regulatory and compliance requirements (HIPAA, data security, confidentiality, industry-specific controls)

-

Confirm version history, approvals, redlines, and signature authenticity

-

Create a checklist to ensure the same standards are applied consistently across all contract types

Good preparation reduces audit time, lowers risk, and uncovers issues before they affect spend or compliance.

What software helps with contract audits?

The best software for contract audits is a contract management system that centralizes contracts, automates documentation, and makes evidence easy to find. Look for:

-

A searchable contract repository with OCR for scanned PDFs

-

Audit trails that record every action taken on a document

-

Role-based permissions to protect sensitive agreements

-

AI-powered categorization and required-field assignment to keep metadata consistent

-

Reporting tools that identify missing information, expired terms, and upcoming renewals

-

Version control, so every amendment and redline is tracked

-

Workflow tools to standardize approvals and reduce discrepancies

These features reduce manual effort, improve accuracy, and make audits faster and more reliable.

%20(1).jpg?width=678&height=376&name=Presentation%20-%20Discover%20ContractSafe%20(678%20x%20376%20px)%20(1).jpg)